Unlocking the Power of Uniswap V4 Hooks

Introduction: Uniswap Hooks and Beyond

Uniswap has continuously evolved, driving the decentralized finance (DeFi) revolution through its different versions. Each upgrade brought groundbreaking features: Uniswap V2 laid the foundation of automated market makers, V3 introduced innovations like concentrated liquidity, and now V4 redefines customization with hooks. Hooks provide an unprecedented level of control and personalization in liquidity pools, allowing developers to extend the functionality of Uniswap beyond its core features.

In this blog, we’ll explore how Uniswap has evolved to meet the needs of liquidity providers (LPs) and developers alike. We’ll delve into Hooks as the central focus, with detailed explanations of their implementation and customization potential. Alongside Hooks, we’ll cover related features like Concentrated Liquidity, Ticks, and sqrtPriceLimitX96—all of which play crucial roles in optimizing capital efficiency.

Concentrated Liquidity in Uniswap

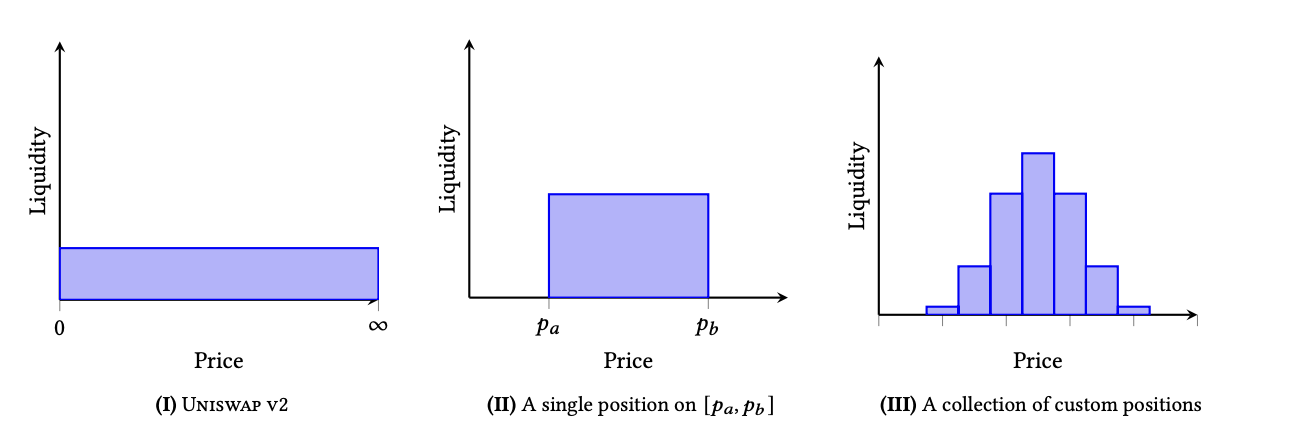

Concentrated liquidity is a revolutionary feature introduced in Uniswap V3, allowing liquidity providers (LPs) to designate a specific price range within which their liquidity is active. This change significantly improves capital efficiency compared to Uniswap V2, where liquidity was spread uniformly across the entire price curve from zero to infinity (0, ∞).

In simple terms, LPs can now focus their liquidity on a specific price range, like setting up a vending stall only in areas with the highest demand. For example, an LP providing liquidity for the ETH/USDT pair might concentrate their assets within the $1,500 to $2,000 price range. This ensures that liquidity is deployed where it is most likely to be used, increasing the potential for earning fees.

Capital Efficiency and Yield Considerations

The main advantage of concentrated liquidity is improved capital efficiency. LPs can provide the same depth of liquidity as they would in Uniswap V2, but with significantly less capital. This also makes it easier for smaller LPs to compete with larger players by strategically positioning their liquidity.

However, the trade-off is the need for active management. If the price moves outside the specified range, the liquidity becomes inactive, and LPs earn no fees until the price returns. This makes liquidity provision in Uniswap V3 more like active portfolio management rather than a passive approach.

To bridge the technical depth, let’s simplify: Concentrated liquidity allows LPs to make their capital work harder for them by narrowing down their focus. Think of it as betting on a horse race—we’re placing our bets on the most likely winning stretch of prices rather than betting on every possible outcome.

Gas Costs

Concentrated liquidity does come with increased gas costs due to the complexity of managing specific price ranges. LPs need to consider whether the potential earnings from concentrated liquidity justify the higher gas fees. For smaller-scale liquidity provision, the benefits of capital efficiency may be offset by these additional costs.

To put it in simpler terms: The efficiency gains come at a price—higher fees when adding or removing liquidity. This is something every LP needs to balance based on their investment size.

Ticks: Discretizing the Price Range in Uniswap V3

Ticks are discrete price points that define the boundaries of liquidity ranges within a Uniswap V3 pool. They enable LPs to concentrate liquidity within specific price intervals, enhancing precision and capital efficiency.

What Are Ticks?

Ticks represent specific price levels, calculated as an integer power of 1.0001. This allows LPs to define a price range for their liquidity. For technical efficiency, Uniswap uses the square root of these prices in its internal calculations.

To make it more relatable: Imagine ticks as units on a ruler that divides a price range into manageable parts, allowing LPs to precisely place their bets on which segment of the range they think is most profitable.

📊 Ticks: Uniswap v3 divides the price range into discrete intervals called ticks. Each tick represents a specific price point. pic.twitter.com/Cd9tEJSrBB

— Panoptic (@Panoptic_xyz) July 16, 2024

Imagine a vendor setting up goods in specific sections of a street market. Ticks help LPs do the same with their liquidity—focusing on price ranges where they expect the most demand. For instance, an LP providing liquidity for the ETH/USDC pair might focus on the $1,500 to $1,600 range, ensuring efficient liquidity deployment when the price stays within this range.

Advantages of Ticks

- Capital Efficiency: LPs can achieve higher returns by focusing liquidity on price ranges with high trading activity.

- Precision in Strategies: Ticks allow LPs to fine-tune their positions, adopting strategies tailored to their risk tolerance and market outlook.

- Enhanced Price Oracle: Ticks improve the accuracy of price oracles, which is beneficial for other DeFi protocols relying on precise price feeds.

Understanding sqrtPriceLimitX96 in Uniswap V3

sqrtPriceLimitX96 is a fixed-point representation of the square root of a price, used as a price limit for certain operations. This parameter is crucial for managing liquidity ranges and preventing excessive slippage during trades.

For example, an LP providing liquidity for the ETH/USDC pool might only want their liquidity to be active when the price is between $1,500 and $1,600. They use sqrtPriceLimitX96 values to set these boundaries, ensuring their liquidity is deployed efficiently within this specific range.

In simpler terms: sqrtPriceLimitX96 is like setting guardrails on our liquidity position. It ensures that we’re only active in a predetermined safe zone, which helps avoid risks from unexpected price moves.

Technical Insights

Uniswap uses Q notation to represent fractional values that Solidity can handle. Specifically, sqrtPriceLimitX96 uses Q96 notation, which involves multiplying the value by 2^96 to maintain precision. This approach allows Uniswap to manage price increments accurately, ensuring efficient liquidity management.

Understanding Hooks in Uniswap V4

Hooks are customizable plugins within the Uniswap V4 protocol. They allow developers to inject custom logic into the execution flow of a pool, providing flexibility beyond the core functionality of Uniswap.

How Hooks Work

Hooks are externally deployed contracts that interact with the core logic of a Uniswap pool. When a pool is created, developers can specify a hook contract, which defines specific functions that are triggered at key events, such as swaps or liquidity changes.

Practical Applications of Hooks

- Dynamic Fee Management: Hooks can adjust swap fees based on market conditions. For example, during high volatility, a hook could increase fees to mitigate risk for LPs.

- Custom Trading Curves: Developers can create custom Automated Market Maker (AMM) curves, such as constant sum curves for stablecoin pairs, using hooks.

- Fee Redirection for Social Impact: Hooks can be used to redirect a portion of trading fees to charitable causes, adding a social impact component to liquidity provision.

Detailed Example of Hook Implementation: Take-Profit Orders

A Take-Profit Order is a type of limit-order that specifies the exact price at which a trader wishes to close their open position for a profit. The order is only filled if the price of the asset reaches the limit price, otherwise it remains open.

For example, imagine ETH is currently trading in the ETH/DAI pool at 1 ETH = 1,500 DAI. We could place a take-profit order that essentially says, “Sell all my ETH if 1 ETH = 2,000 DAI.” If and when that price is hit, our ETH will automatically be swapped over to DAI completely on-chain in a decentralized way.

Step-by-Step Implementation Overview:

- Create Hook Contract: We need a smart contract that defines the logic for managing take-profit orders. This includes functions for placing, canceling, and redeeming orders.

- Place Order: Users place an order by interacting with the hook contract. The contract mints ERC-1155 tokens representing their order, which serve as receipts for the user. These tokens can be traded or transferred while the order is open.

- Cancel Order: Users can cancel their order at any time, and the corresponding ERC-1155 tokens are burned. The user’s assets are returned without the order being filled.

- afterSwap Hook: Each time a swap occurs in the pool, the afterSwap hook is triggered. The contract checks the current price against open take-profit orders. If the target price is reached, the order is automatically filled, and the user’s tokens are swapped.

- Fill Order: To fill an order, the hook prepares the swap parameters, such as sqrtPriceLimitX96, and handles the swap. The logic includes tracking order type, maximum slippage, and ensuring that all calculations are accurate.

- Redeem Tokens: Once the order is filled, users can redeem their swapped tokens by returning the ERC-1155 receipt tokens to the contract. The contract burns these tokens and transfers the swapped assets to the user.

A detailed example of the take-profit hook can be found here. Additionally, you can also refer to this curated lists of awesome hooks resources.

Technical Insights into Hooks

Hooks are designed to be modular and easily integrated. This allows developers to iterate on their hook logic separately from the core protocol, providing additional security and flexibility. For example, dynamic fee adjustments based on external Oracle data or changing AMM behavior based on market volatility can all be seamlessly integrated with Hooks.

The Take-Profit Hook leverages the afterSwap hook to monitor each swap event and compare the new price against existing orders. This modularity ensures that any price movement in the pool is captured, allowing pending orders to be filled automatically.

Conclusion

Each version of Uniswap has brought unique innovations that have revolutionized decentralized finance. The concentrated liquidity and ticks features from V3 allow for greater capital efficiency, while hooks from its V4 version advancements provide unprecedented customization for developers and liquidity providers. By understanding these features, LPs can make informed decisions about how to deploy their capital most effectively, whether they prefer passive strategies or more active management.

In a nutshell, this evolution showcases the power of customization, efficiency, and flexibility. Hooks, in particular, open up new possibilities for developers to add personalized behavior to liquidity pools, making Uniswap more adaptable and community-oriented than ever.

Enjoy Reading This Article?

Here are some more articles you might like to read next: